What to Include in an SD-WAN and SASE RFP for Retail (Enterprise and Mid-Market Considerations)

Retail SD-WAN and SASE RFPs require sector-specific requirements. Structured procurement processes ensure vendors respond to comparable criteria rather than submitting marketing-led proposals that obscure capability gaps.

Retail organisations depend on network connectivity for every transaction, inventory update and customer interaction across hundreds or thousands of distributed locations. When procurement teams issue generic SD-WAN or SASE requests for proposals without retail-specific requirements, vendors submit responses optimised for corporate campus environments that fundamentally misunderstand store operational constraints.

Traditional office-focused RFP templates cannot address retail's operational reality: stores generate revenue during specific trading hours when network failures directly impact sales, payment processing operates under strict compliance requirements that necessitate network segmentation, and the sheer number of locations makes centralised remote management non-negotiable. Beyond this, retail networks must handle predictable demand spikes during peak trading periods without degrading point-of-sale performance, whilst simultaneously supporting expanding operational technology including digital signage, inventory management systems, edge AI analytics and customer engagement platforms.

Why Retail SD-WAN and SASE RFPs Are Different

Retail represents a fundamentally distinct networking environment from corporate offices, creating procurement challenges that generic RFP templates fail to address. Store networks operate under constraints that don't exist in corporate environments - when a store network fails during Saturday afternoon trading, the immediate impact is lost revenue, frustrated customers and potential compliance breaches if payment processing falls back to manual processes.

The distributed nature of retail operations creates management challenges that office-focused solutions cannot address. Retail organisations typically operate dozens, hundreds or thousands of locations with minimal or no on-site IT expertise - store managers and sales associates cannot diagnose connectivity issues or execute configuration changes. When vendors propose solutions requiring local technical intervention for routine operations - RFPs must therefore explicitly define requirements around zero-touch deployment, automated failover and remote troubleshooting capabilities.

Regulatory and security exposure at the store edge differs also from corporate environments. Stores process payment card transactions under PCI DSS 4.0.1 requirements that mandate network segmentation between cardholder data environments and general store networks, handle customer personal data subject to UK data protection regulations including the Data (Use and Access) Act 2025 and increasingly connect operational technology that expands the attack surface. Unlike corporate offices where IT security teams maintain direct oversight, store networks must enforce security policies automatically without requiring local expertise.

Defining the Scope of a Retail SD-WAN or SASE RFP

Proper scope definition determines whether an RFP produces actionable vendor comparisons or generates responses too varied to evaluate fairly, therefore it's important to ensure you prioritise the most relevant elements to define and provide detailed content for each. For example, geographic spread and site count typically represents the primary scoping parameter - an RFP for 50 stores concentrated in Southeast England presents different connectivity options compared to 500 stores distributed across the UK and Ireland. Vendors should be informed of not just the total number of locations but also their distribution pattern, as concentrated urban deployments enable different connectivity approaches than rural sites (where fibre availability and backup connectivity options differ significantly).

Further to this, store types and operational models create substantially different requirements within a single organisation. For example, large format stores with extensive stockrooms and multiple point-of-sale zones require different network architectures than small convenience stores, whereas franchise locations may have different connectivity integration and procurement models than corporate-owned stores. Retail organisations operating the likes of legacy MPLS networks face different procurement considerations than those with mixed broadband connectivity or 4G/5G backup and therefore the RFP must specify current architecture, performance baselines (where available) and any constraints around migration timing or phased rollouts.

Core Functional SD-WAN Requirements for Retail

Retail SD-WAN requirements must address the operational realities of distributed store environments where transaction continuity, remote management and traffic prioritisation determine solution appropriateness.

Security and SASE Requirements in Retail Environments

Retail network security requirements differ fundamentally from corporate environments due to payment processing compliance obligations, distributed attack surface at store edges, and the need for consistent security enforcement across locations lacking on-site security expertise.

Store Segmentation

Store segmentation principles represent the foundational security requirement. Payment processing systems and point-of-sale terminals must operate in segmented network zones isolated from guest WiFi, digital signage and other general store systems. PCI DSS 4.0.1, which became fully effective in late 2025, explicitly requires separation of cardholder data environments and introduces additional requirements around automated technical solutions to prevent web-based script attacks such as e-skimming.UK Data Protection Compliance

UK data protection compliance, particularly under the Data (Use and Access) Act 2025, creates specific requirements for retailers operating in the United Kingdom. This legislation introduces new standards for data processing related to crime prevention - directly relevant for retail surveillance systems, theft detection and fraud prevention activities. Maximum fines for PECR breaches have increased to £17.5 million or 4% of global turnover, making compliance a critical procurement consideration.Secure Internet Breakout

Secure internet breakout from stores represents a fundamental architectural decision. Traditional retail networks backhaul all store traffic through data centres where corporate security infrastructure inspects it - this approach protects stores but introduces latency that degrades cloud application performance. SASE architectures allow stores to access internet resources directly whilst enforcing security policies at the network edge.Identity-Based Access Controls

Identity-based access controls determine whether retail organisations can enforce least-privilege principles where store staff, IT administrators and maintenance contractors access only the systems necessary for their roles. SASE solutions often incorporate zero trust principles where authentication and authorisation occur before network access rather than relying on network location.Performance, SLAs and Operational Requirements

Retail organisations should provide requirements that address real-world requirements for store scenarios where network behaviour directly impacts business outcomes.

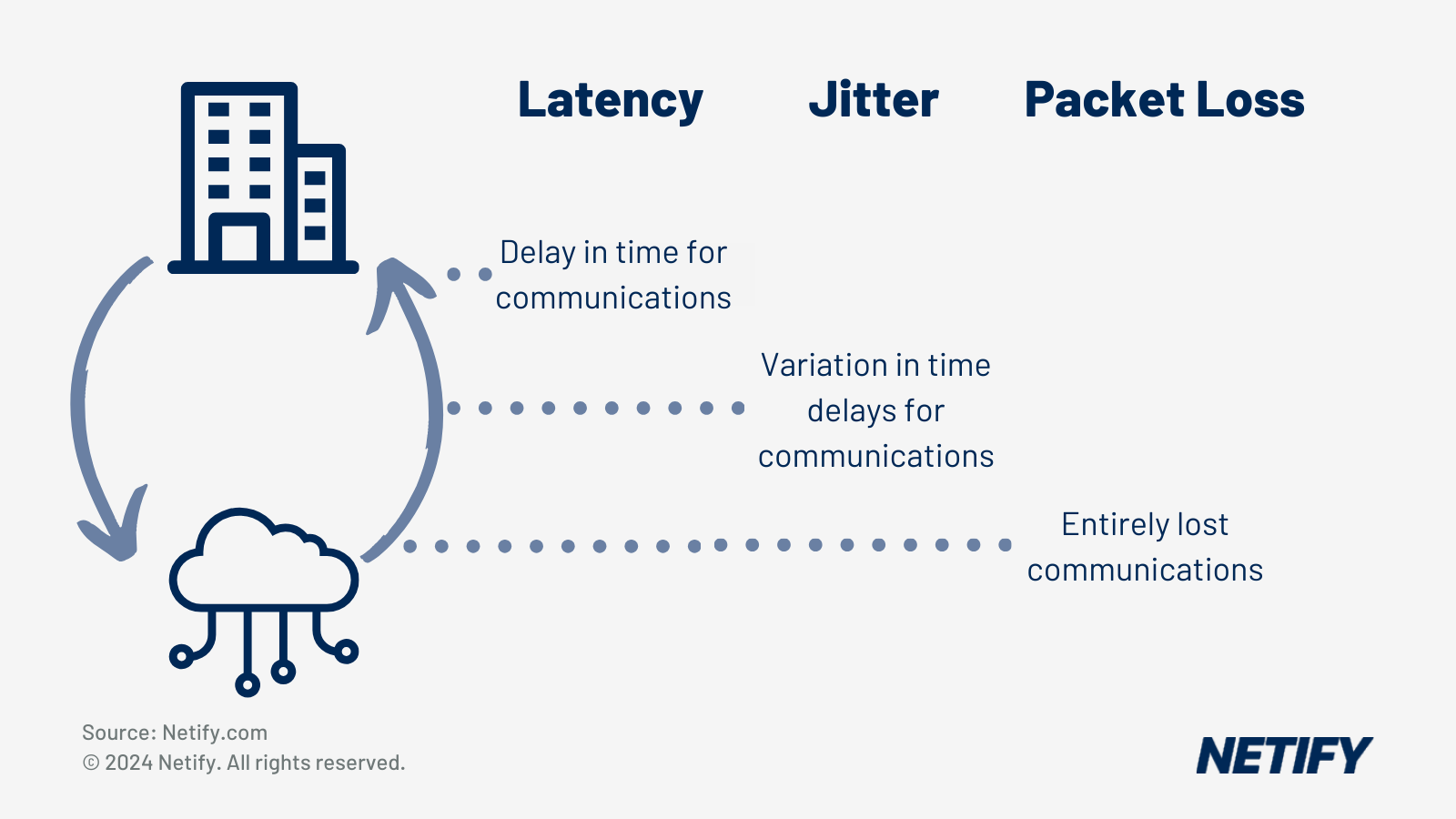

Latency and packet loss expectations vary dramatically based on store application types - point-of-sale systems typically require sub-100ms round-trip latency for responsive operation and higher latency creates noticeable delays that slow transaction throughput or leave transactions abandoned. And with the integration of newer systems like edge AI systems that process computer vision for automated checkout processes, new latency requirements are being introduced, where issues are even more pronounced and delays directly affect customer experience.

It's important to also understand how to phrase your availability requirements to ensure vendors respond in the correct manner. A vendor claiming "99.9% uptime" may calculate availability based on overall service infrastructure, mean across all stores or individual store performance, therefore retail RFPs must define precisely how availability is calculated and specify whether requirements represent individual store performance or fleet averages.

Enterprise vs Mid-Market Retail Considerations

Retail organisations at different scales face fundamentally different network challenges, and understanding these distinctions is essential for appropriate solution selection.

Internal IT capability represents the most significant/one of the more variable facets. Large retail chains typically employ dedicated network operations teams and possess expertise to manage complex multi-vendor environments and these organisations can accommodate architectural complexity in exchange for capability. Mid-market retailers, on the other hand, often operate with lean IT teams where network management represents one responsibility among many, requiring solutions that are operationally simple rather than architecturally flexible.

Complexity versus simplicity trade-offs. Given the above point, enterprise retailers (where more expertise is often on-hand) can benefit from granular policy controls and sophisticated traffic engineering, but of course, these capabilities come with operational overhead that enterprise IT teams can absorb. Mid-market retailers, however, often fare better with solutions that provide sensible defaults, limited configuration options and automated operation that doesn't require deep networking expertise.

Vendor engagement models differ significantly - enterprise retailers typically work directly with SD-WAN vendors and may require dedicated account teams, whilst mid-market retailers often benefit from managed service provider relationships where MSPs handle day-to-day operational complexity and provide expertise that internal teams lack.

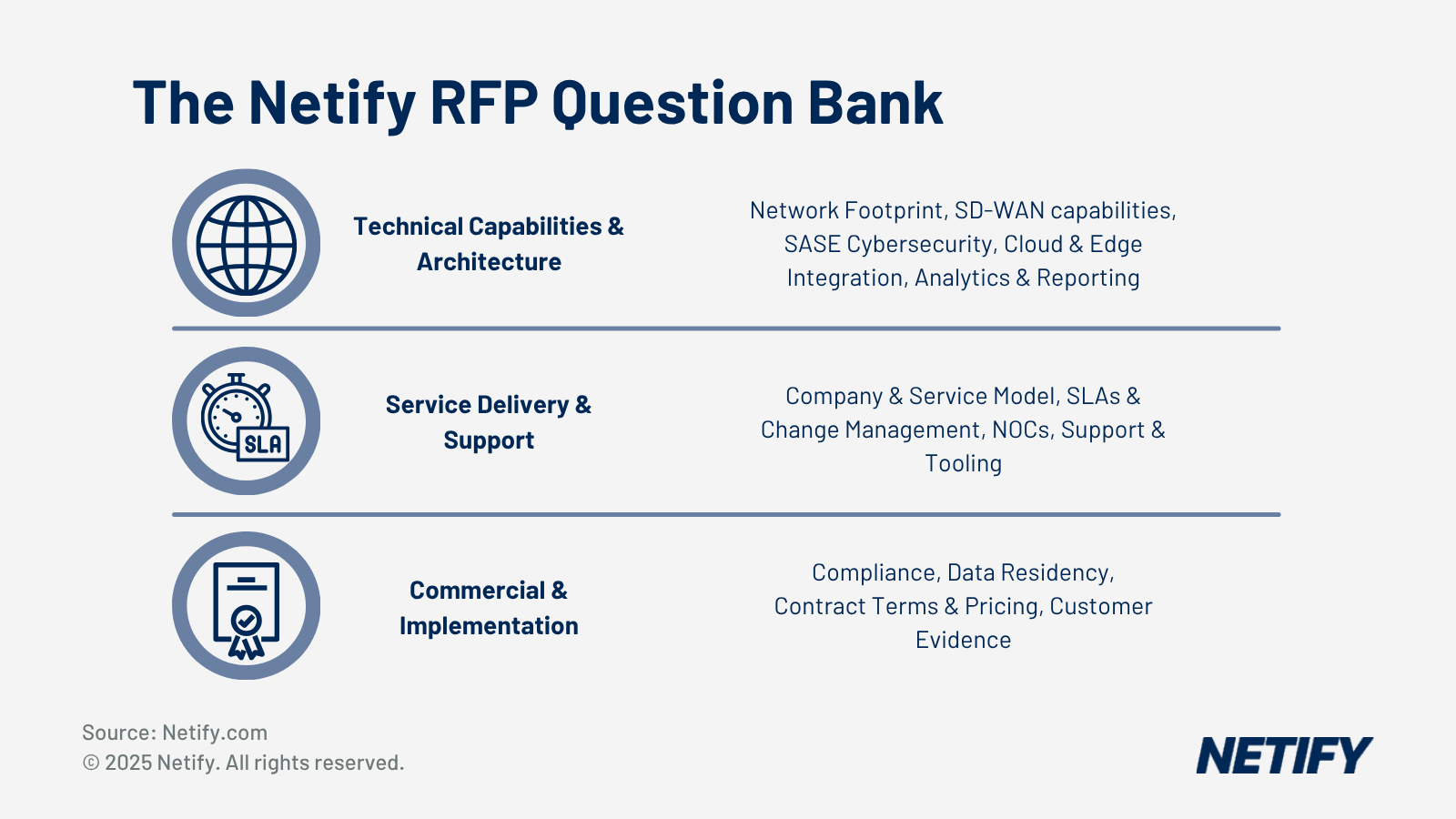

Turning Requirements into an RFP Structure

To create a standardised RFP structure, we'd recommend that requirements are grouped into logical sections that reflect procurement decision factors - technical requirements covering connectivity behaviour, security and segmentation requirements addressing compliance obligations, alongside any operational requirements.

Vendor-biased questions should also be removed - such as questions like "Does your solution support MPLS?" inherently implies that MPLS is a must for your business even when many retailers have migrated to broadband-first approaches. The most effective retail RFPs focus on operational outcomes, such as "Describe how your solution maintains point-of-sale connectivity when the primary circuit fails during peak Saturday trading", rather than asking vendors to confirm they support specific technical features.

Harry holds a BSc (Hons) in Computer Science from the University of East Anglia and serves as a Cybersecurity Writer here at Netify, where he specialises in enterprise networking technologies. With expertise in Software-Defined Wide Area Networks (SD-WAN) and Secure Access Service Edge (SASE) architectures, Harry provides in-depth analysis of leading vendors and network solutions.

Fact-checked by: Robert Sturt - Managing Director, Netify

FAQ

How long should an SD-WAN RFP take?

Typical retail SD-WAN RFP timelines span 8-12 weeks from issuance to vendor selection. Enterprise retailers with formal procurement governance may require 16-20 weeks, whilst mid-market retailers with streamlined decision-making can often complete evaluation within 6-8 weeks.

How many vendors should retailers invite?

Most retail organisations issue RFPs to 4-8 vendors, balancing evaluation thoroughness against review burden. Retailers should prioritise vendor diversity over quantity, ensuring shortlists include both established platforms and emerging solutions.

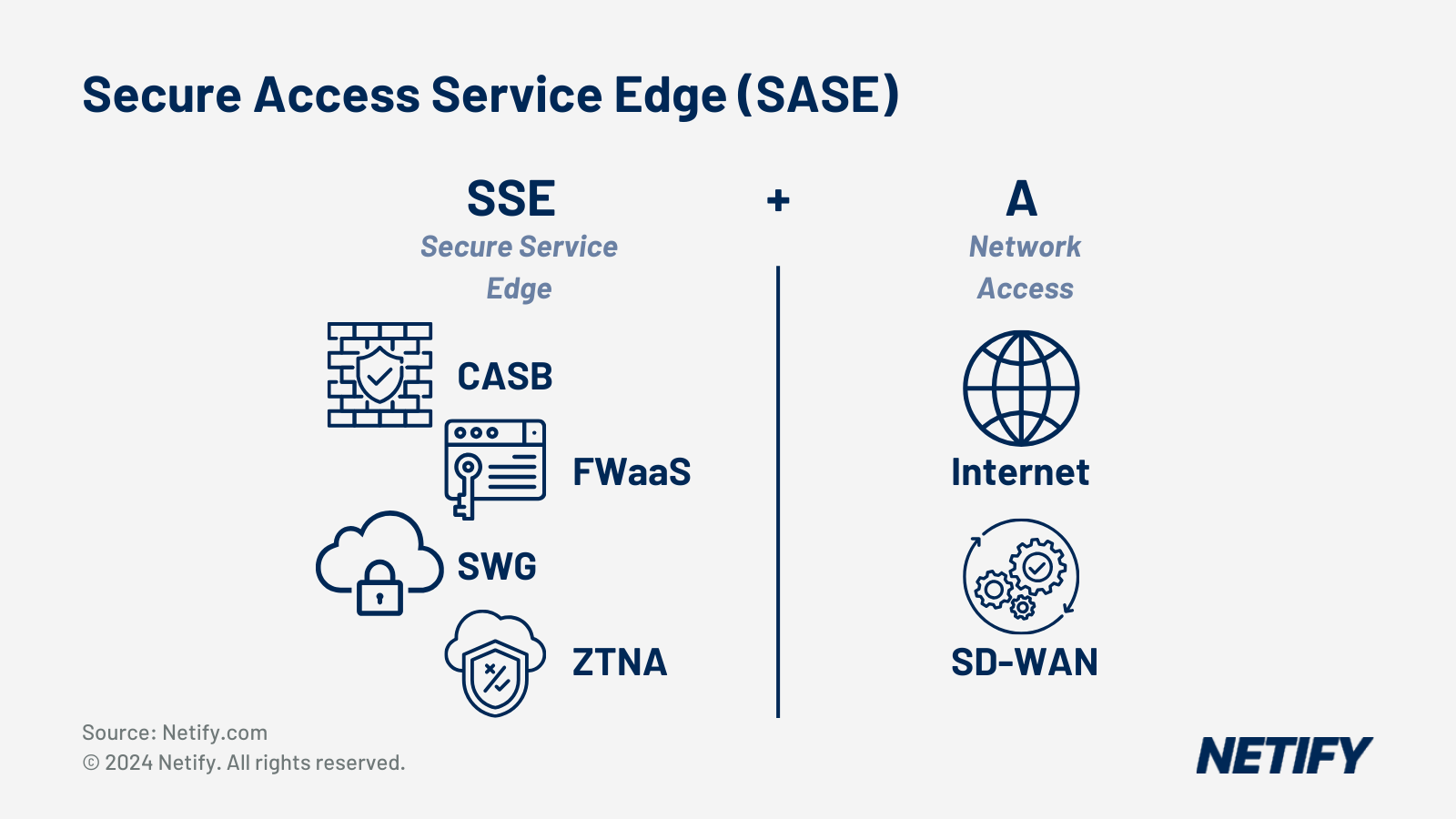

Can SD-WAN and SASE be combined in one RFP?

Retailers can structure procurement as pure SD-WAN, integrated SASE, or SD-WAN with separate security evaluation depending on organisational requirements. Organisations seeking to consolidate networking and security management benefit from combined SASE RFPs that evaluate vendors' integrated capabilities.

Next Steps for Retail Organisations

Retail procurement teams beginning SD-WAN or SASE evaluation should prioritise structured requirements definition before engaging vendors and the most common procurement failure is issuing RFPs with ambiguous requirements that prompt varied vendor responses that aren't intuitive to compare.

Organisations lacking internal expertise benefit from leveraging frameworks designed for distributed operations. Generic enterprise RFP templates fail to address store operational constraints, whilst vendor-provided templates often contain biased questions and that's why Netify's RFP Builder is an ideal solution, guiding retail organisations through defining requirements, structuring evaluation criteria and generating RFP documents tailored to store operations without vendor bias. Our platform connects retailers with curated SD-WAN and SASE vendors who respond to identical structured requirements, enabling direct comparison based on consistent criteria rather than marketing-differentiated proposals that obscure capability gaps affecting store operations.