How to Evaluate and Score SD-WAN and SASE Vendors for Retail Operations

Retail procurement teams evaluating SD-WAN and SASE vendor proposals face a fundamental challenge: inconsistent responses make fair comparison difficult without a standardised framework in place.

The challenge of evaluating vendors is only made worse given that retail organisations at different scales require fundamentally different solutions, with capabilities essential for enterprise retailers managing hundreds of stores often creating unnecessary complexity for mid-market operations with much less locations. In this article we'll cover our scoring framework that addresses retail-specific evaluation criteria across connectivity performance, security integration, operational management and commercial terms (distinguishing between enterprise and mid-market requirements where appropriate).

Establishing Retail-Specific Evaluation Criteria

Retail SD-WAN evaluation must focus on capabilities directly affecting store operations rather than generic networking features - for example transaction continuity during connectivity failures represents the most critical element and when stores lose primary connectivity during peak trading, solutions must maintain point-of-sale processing, payment authorisation and inventory updates without store staff intervention to ensure business is not lost. Evaluation should, in this instance, therefore focus on failover speed (sub-second versus multi-second transitions), transaction completion behaviour during failover and automatic restoration when primary connectivity returns.

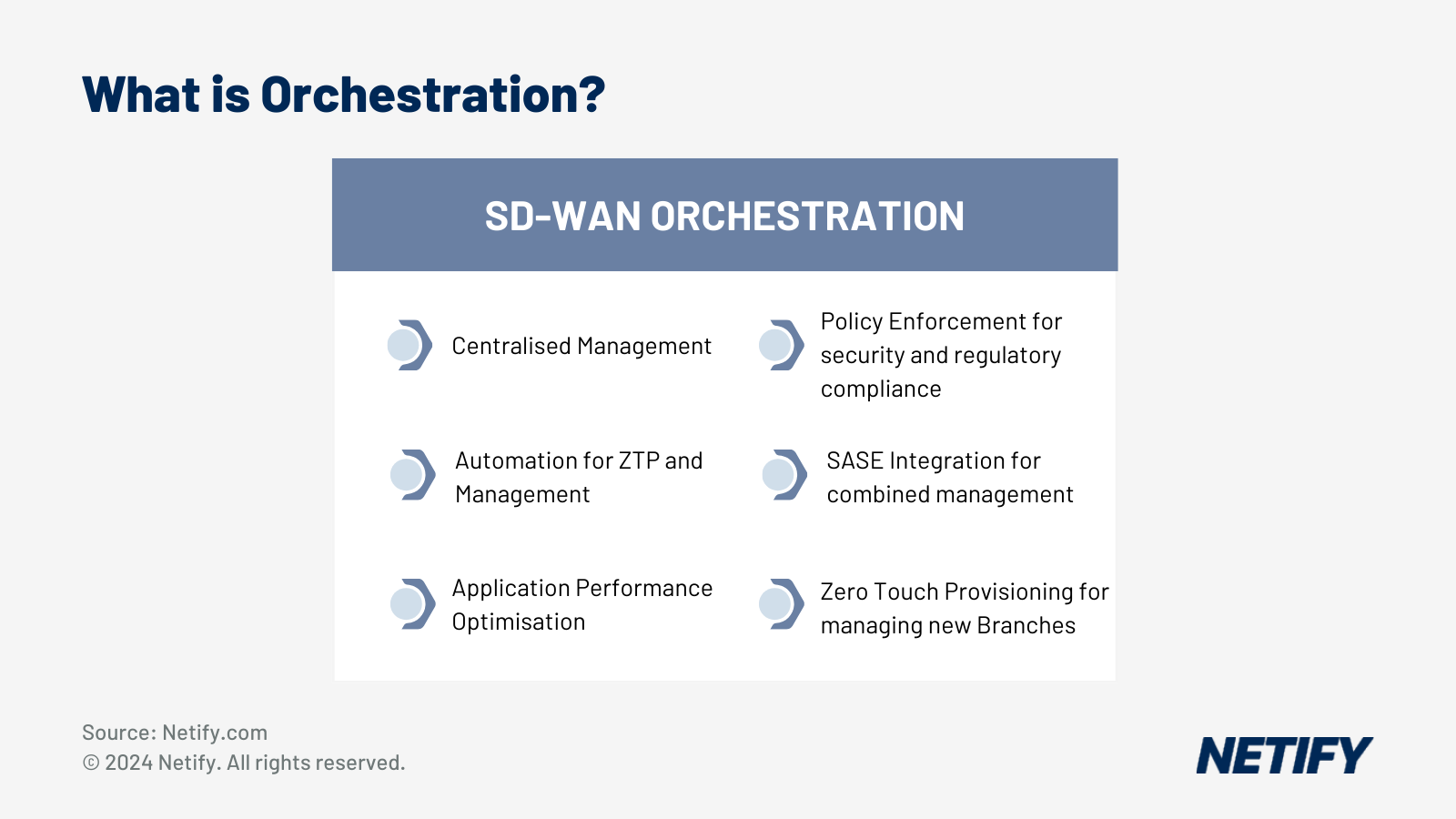

On top of this, given that most retail sites don't have their own dedicated IT or network expertise, remote management and troubleshooting capabilities determine whether retail IT teams can diagnose and resolve issues without store staff involvement or sending experts from other locations in person - which can be largely beneficial for saving on operational costs. Assessments on remote management should therefore cover centralised visibility into store connectivity, application performance and security events, as well as diagnostic capabilities for enabling remote root cause identification and policy management supporting consistent configuration across hundreds or even thousands of stores.

When managing a network, retailers are no exception from the latest trends, with AI-driven operational automation (AIOps) becoming evermore present, particularly for distributed store estates where manual intervention can't be scaled. Evaluation for AI-driven approaches should focus on autonomous resolution of common connectivity issues before they impact sales (such as automatically switching traffic to backup circuits when primary connections degrade, adjusting priorities during congestion, or identifying and remediating configuration drift).

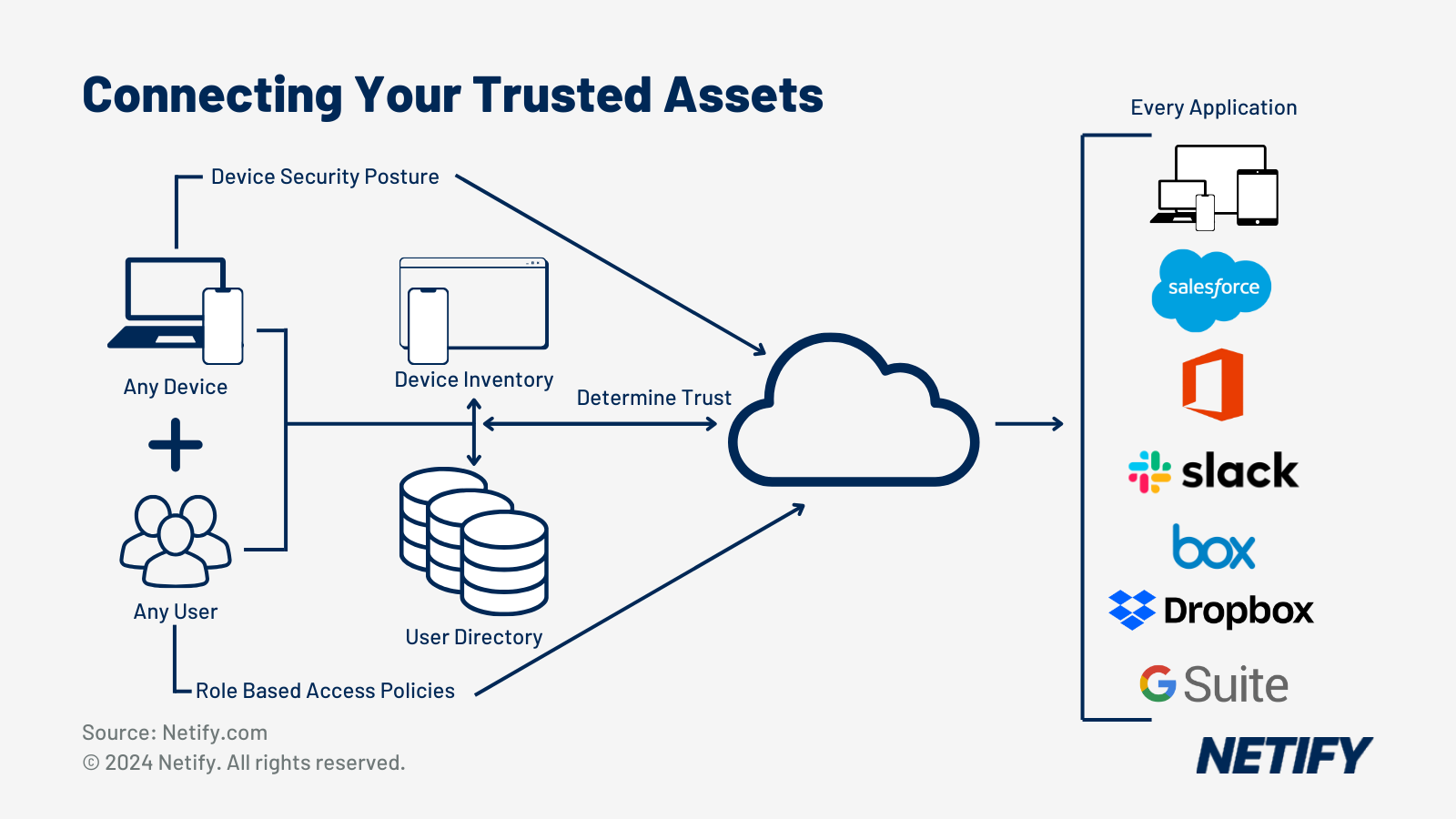

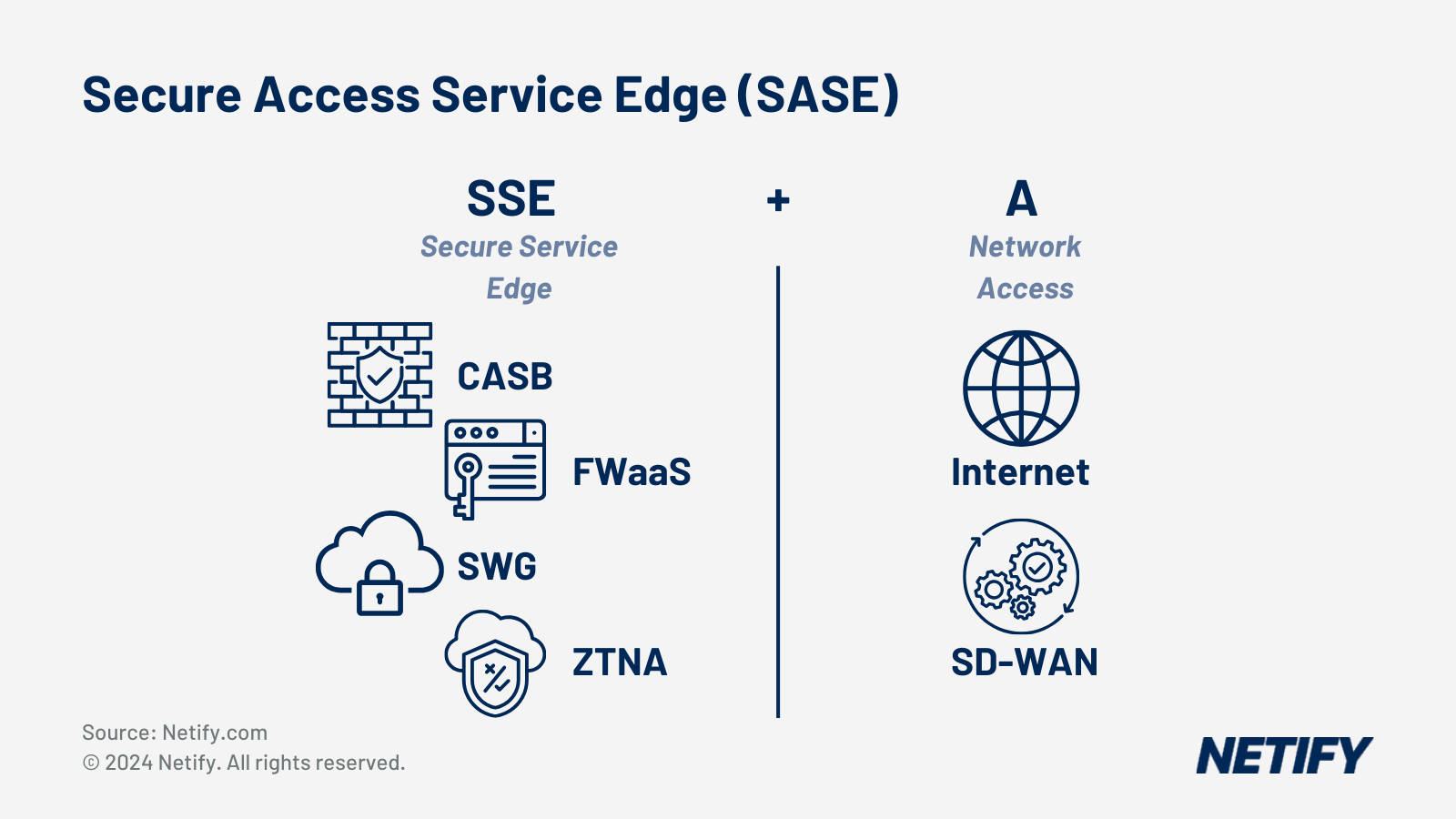

And whilst Gartner has stated that mature platforms resolve 80% or more of common issues without human intervention, human-led issue resolution can often be reliant on the capabilities of security integrations. Security integration and segmentation enforcement affect whether solutions maintain PCI DSS 4.0.1 compliance whilst protecting transaction systems and the latest requirements mandate automated technical controls preventing web-based script attacks (e-skimming). Zero Trust Network Access (ZTNA) 2.0 capabilities have become essential, providing significantly stronger protection against credential-based attacks and vendors offering only basic ZTNA 1.0 or traditional network controls should score lower than those providing ZTNA 2.0 with identity-based access enforcement, continuous trust verification and micro-segmentation.

Finally, the use of edge AI and IoT integrations have also added to the growing list of retailer requirements, with these smart store technologies creating new network demands. With computer vision for automated checkout and real-time analytics, these devices generate high-bandwidth, low-latency traffic that can compete with transaction processing and therefore understanding how vendors mitigate potential issues is vital.

Creating Objective Scoring Frameworks

Structured scoring is essential to prevent subjective evaluation and to create a systematic assessment for procurement decisions. As with the Netify RFP builder application, we'd recommend ten-point scales (0-10) for scoring each component as these offer sufficient granularity whilst remaining simple for consistent application - with each score range requiring explicit criteria defining what vendor responses must demonstrate to achieve that rating.

Enterprise versus Mid-Market Scoring

Enterprise retailers can weight architectural flexibility, extensive integration and sophisticated traffic engineering more heavily because they possess expertise to manage complexity. However, mid-market retailers should weight operational simplicity, vendor-provided support and automated management more heavily as typically more-lean IT teams cannot absorb the significant operational overhead. Regardless of size, though, core criteria (such as transaction continuity, security integration, remote troubleshooting) will often remain critical regardless of scale and should receive substantial weight in both frameworks.

Connectivity and Performance Evaluation

Security and Compliance Scoring

PCI DSS 4.0.1 Compliance

Exceptional scoring requires vendors holding PCI DSS 4.0.1 Attestation of Compliance as Level 1 Service Provider, solutions providing fully automated technical controls preventing web-based script attacks, network segmentation enforcing cardholder data environment isolation without local configuration, and comprehensive centralised audit reporting. Good performance requires PCI DSS 4.0.1 compliance capabilities with moderate configuration required, automated script attack prevention, and effective segmentation capabilities. Both enterprise and mid-market retailers should weight PCI DSS compliance heavily (15-20%) as non-compliance carries significant financial and reputational risk regardless of organisational scale.

ZTNA 2.0 and Identity-Based Access

Native ZTNA 2.0 integration providing identity-based access enforcement, continuous trust verification based on user, device, context and behaviour analytics, advanced micro-segmentation supporting least-privilege access, and seamless integration with major identity providers scores exceptionally. According to Gartner ZTNA research, ZTNA 2.0 directly addresses credential-based attacks representing primary breach vectors in 2026. Enterprise retailers with sophisticated identity infrastructure should weight ZTNA 2.0 at 15%, whilst mid-market retailers may weight this at 10-12%.

UK Data Protection Compliance

Solutions must support UK Data (Use and Access) Act 2025 requirements with comprehensive documented approaches to surveillance data handling for crime prevention purposes, automated audit capabilities demonstrating lawful data processing, and centralised policy enforcement across UK store estates. UK-based retailers should weight this at 10-12%, whilst North American retailers may substitute equivalent regional requirements.

Integrated SASE Security Functions

SASE integration with fully unified management of networking and security, secure web gateway, firewall-as-a-service, CASB and DLP included without separate procurement scores exceptionally. Enterprise retailers with existing security infrastructure may weight SASE integration at 10-15% depending on consolidation goals and mid-market retailers seeking to simplify security management should weight this at 15-20% as integrated solutions significantly reduce operational burden.

Operational Management and AIOps

Commercial Terms and Support

Pricing Transparency

Completely transparent per-store pricing including all components with zero hidden fees for essential features, clear scaling costs with volume discounts, predictable operational expenditure model, and multi-year price protection with explicit caps scores exceptionally. Both enterprise and mid-market retailers should weight pricing transparency at 8-10% as it affects budget planning regardless of scale.

Support Model

24/7/365 support perfectly aligned to retail trading hours across all time zones with guaranteed response times for transaction-impacting issues (under 15 minutes), dedicated account teams, proactive monitoring with outbound notification, and extensively documented retail customer satisfaction scores exceptionally. Mid-market retailers should weight support heavily (12-15%) as lean IT teams depend on vendor operational assistance. Enterprise retailers with internal expertise can weight this at 8-10%.

Contract Flexibility

Highly flexible terms accommodating store expansion and contraction with minimal penalty, reasonable early termination provisions, vendor-assumed performance risk through SLAs with meaningful financial penalties, and comprehensive pilot options before full commitment score exceptionally. Both enterprise and mid-market retailers should weight contract flexibility at 6-8%.

Avoiding Common Evaluation Pitfalls

Feature quantity bias occurs when vendors submit responses listing extensive feature sets to create impressions of superior capability regardless of whether features address retail operational needs. To mitigate this issue, we'd suggest that you focus your evaluation criteria exclusively on capabilities that affect your retail operations.

Marketing terminology acceptance can also occur when vendor responses use terms like enterprise-grade or industry-leading without substantive evidence - evaluators may subconsciously score vendors higher for confident language even when concrete demonstrations are lacking. We'd therefore suggest that you look for/require specific evidence-based assessment that demonstrates capability over marketing assertions.

Compiling Final Vendor Scores

To gain a final vendor scores, multiplying individual criteria scores by any assigned weights and summing across all evaluation categories to gain an easily comparable total score.

Next Steps for Implementation

Retail procurement teams should develop evaluation frameworks before issuing RFPs rather than creating scoring methodologies after receiving vendor responses. This sequencing ensures evaluation criteria reflect genuine operational requirements rather than post-hoc justification for subjective preferences.

Netify's RFP Builder provides evaluation frameworks with a bank of pre-written questions to suit a wide variety of business needs.

Harry holds a BSc (Hons) in Computer Science from the University of East Anglia and serves as a Cybersecurity Writer here at Netify, where he specialises in enterprise networking technologies. With expertise in Software-Defined Wide Area Networks (SD-WAN) and Secure Access Service Edge (SASE) architectures, Harry provides in-depth analysis of leading vendors and network solutions.

Fact-checked by: Robert Sturt - Managing Director, Netify