The 2025 Market Guide to Secure Global SD-WAN Managed Service Providers

We've covered the best Managed SD-WAN services (including AT&T, Verizon, Lumen, Comcast, BT, Vodafone, Colt, GTT, Aryaka, Hughes, Zayo and MetTel), their key differentiators and unique selling points.

Market Overview: Managed SD-WAN Services in 2025

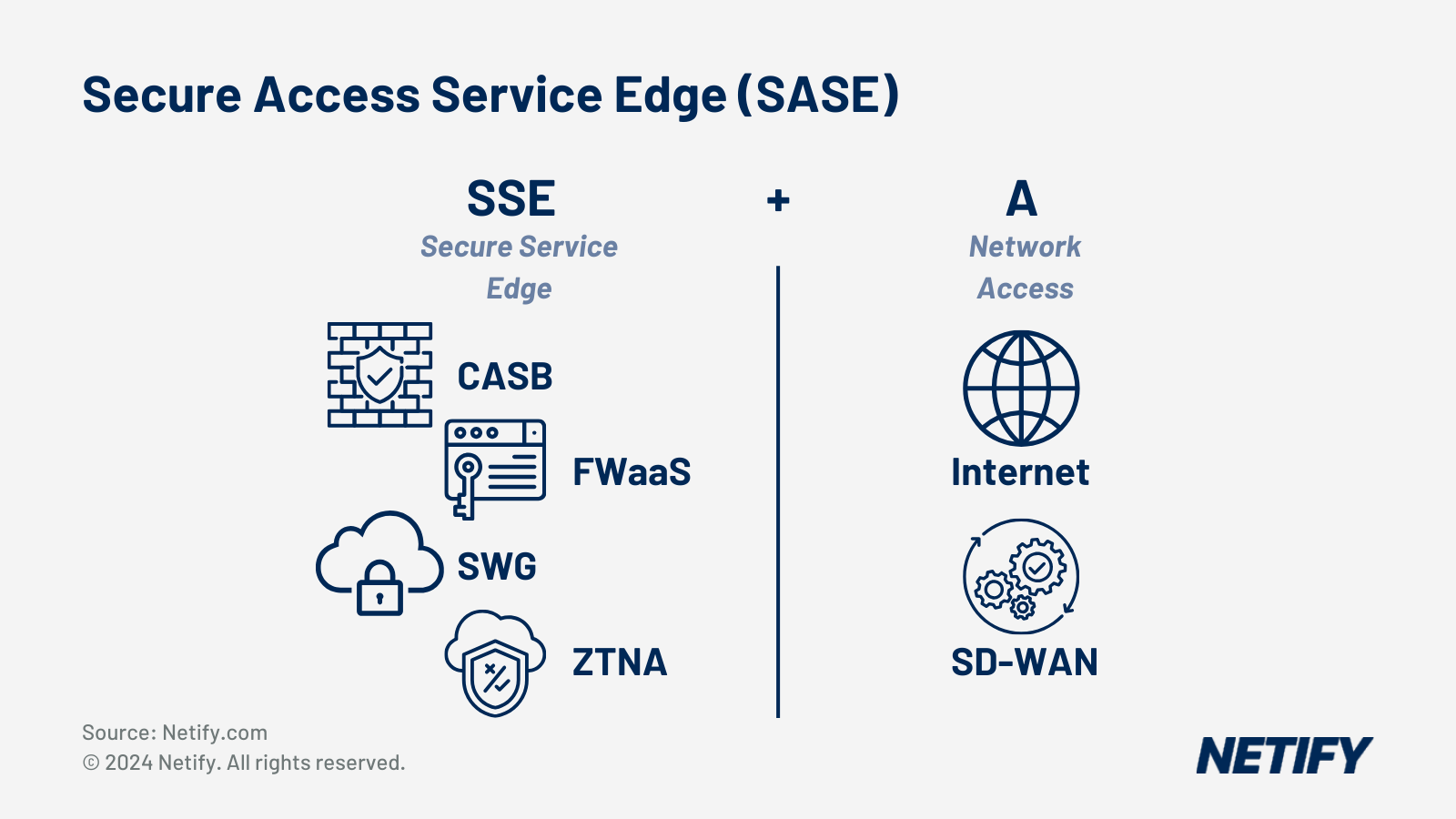

Managed SD-WAN solutions enable organisations to balance business needs such as performance, security and operational efficiency—significantly improving user experiences. By converging network technologies, cybersecurity protocols and cloud-native architectures, SD-WAN can provide real-time threat mitigation while delivering scalable, intelligent networking capabilities across global operations.

As we look towards the latter end of 2025, we're expecting the SD-WAN market to continue to grow, with increased focus on integration with SASE frameworks and zero-trust architectures. Providers are increasingly differentiating through AI-driven operations, sustainability initiatives and specialised industry solutions. Enterprise adoption has accelerated dramatically, with over 70% of multinational organisations now implementing some form of SD-WAN to support distributed workforces and multi-cloud environments. The trend towards consolidation amongst providers continues, with telecommunications giants acquiring specialist SD-WAN vendors to strengthen service portfolios and extend global reach.

Table of Contents

Why Choose Managed SD-WAN vs DIY SD-WAN

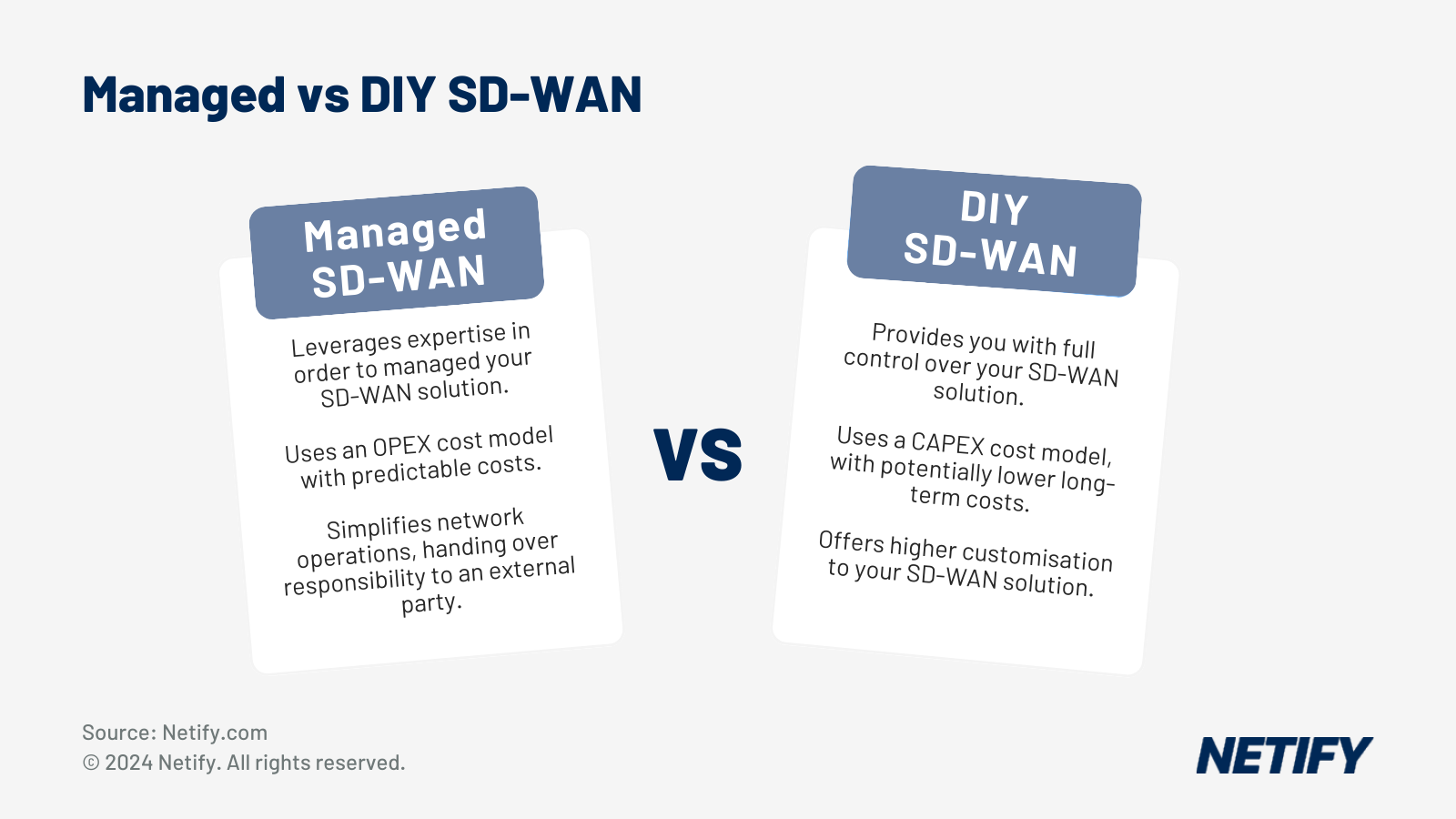

IT decision makers often question whether to choose a managed SD-WAN network or a more hands-on approach. Whilst DIY SD-WAN and in-house implementations offer greater control, managed services alleviate network management responsibilities. By utilising technological expertise from specialised providers, organisations' internal IT teams can focus on integrating new technologies and advancements, rather than worrying about network uptime, security vulnerabilities or latency issues for Software-as-a-Service (SaaS) applications.

It should also be noted that co-managed opportunities create a balance between managed and DIY SD-WANleaving experts to take on the responsibility of the overall network that managed SD-WAN involves, whilst the control elements of DIY SD-WAN are also implemented for IT teams to utilise.

When considering cost efficiency and potential ROI, managed SD-WAN providers can prove beneficial not only upon deployment but also through continuous monitoring, security updates and technical support. This provides organisations with predictable operational expenses, reduced complexity and the flexibility to quickly make changes to deploymentsoffering rapid adjustments that often outperform internal IT teams.

Key Evaluation Criteria for Secure SD-WAN Providers

Given the vast capabilities that SD-WAN has to offer, it's important that IT decision makers consider all facets of each solution to ensure shortlisted options are best tailored to their requirements.

Deployment Models

Fully managed • Co-managed • External expertise

Geographic Coverage

Network reach • Regional alignment • Global connectivity

Service Level Agreements

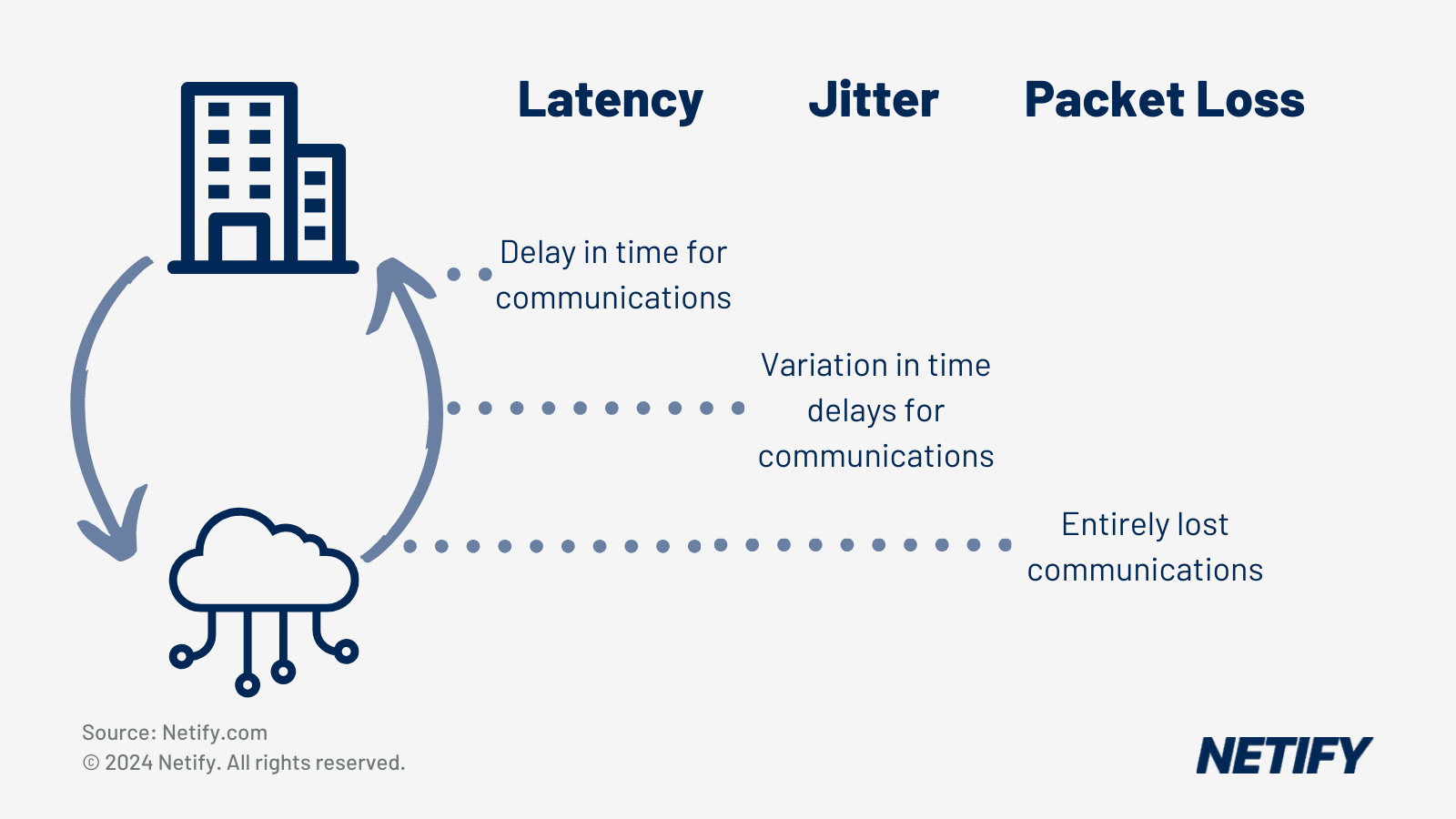

Performance guarantees • Latency • Uptime metrics

NOC and Support

24/7 monitoring • AI-driven automation • Certified engineers

Enhanced Security

SASE • Zero Trust • Cloud integration • CASB

Analytics and Reporting

Real-time data • Performance monitoring • ROI tracking

Compliance Support

GDPR • HIPAA • ISO 27001 • Data sovereignty

Pricing Models

Per-site fees • Contract terms • TCO • Hidden costs

Legacy Systems

Scalability • Cloud applications • WAN integration

Methodology

Our analysis draws from multiple authoritative sources collected between January and May 2025:

- Gartner Magic Quadrants for 2025

- Frost & Sullivan Global Managed SD-WAN Market Assessment

- Direct vendor documentation and SLA agreements

- Customer satisfaction surveys

- Financial performance data from telecommunications industry reports

The Netify Comparison of Managed Service Providers

We've detailed the leading SD-WAN telecommunications carriers and MSPs from the UK and North America that offer global capabilities. Whilst all solutions deliver core network management functionality, each differ in their delivery models, regional strengths and the customers they target.

AT&T

AT&T Business - Managed SD-WAN Provider

Overview

Headquartered in Dallas, USA, AT&T is a leading global telecommunications provider with the highest share of the global managed SD-WAN market. Their extensive network spans more than 200 countries across the Americas, EMEA and Asia-Pacific, offering the SD-WAN overlay an extensive backbone and widespread partner access.

AT&T offers both fully managed and co-managed SD-WAN solutions with support for multiple technologies (Cisco Catalyst, VMware VeloCloud). Their service is backed by 99.99% uptime SLAs, 24/7 global NOCs with follow-the-sun support, and 4-hour on-site hardware replacement in major cities. Same-day change requests are often accommodated, and AT&T provides multi-language support for multi-region use cases.

AT&T partners with Palo Alto Networks and other security specialists, or leverages their in-house cybersecurity unit, to deliver SASE capabilities. They also provide direct cloud connectivity to major cloud services including AWS, Azure and Google Cloud Platform.

AT&T's reputation centres around their reliability and convenience as a one-stop shop that can bundle multiple access types - MPLS, Internet, 5G wireless and SD-WAN - under a single contract.

Pros and Cons

Pros

| Previously held #1 position in US managed SD-WAN market for six years before Comcast took the lead in 2025 |

| Extensive backbone infrastructure with service in more than 200 countries and territories |

| One of only three providers with MEF 3.0 SD-WAN certification (along with Orange Business and Verizon) |

| Multi-vendor platform support provides flexibility |

Cons

| Lost market leadership position to Comcast Business in 2025 after six-year run |

| Complex contract structures with lengthy terms (typically 3 - 5 years) |

| Premium pricing compared to some competitors |

| Large organisation structure can slow change implementations |

Service Details

Verizon Business

Overview

Verizon Managed SD-WAN solutions for Global companies

Verizon Business are one of the largest telecommunications providers in America, delivering enterprise-grade network solutions to Fortune 500 companies and governmental organisations worldwide. Following significant investments in fibre optic infrastructure and strategic acquisitions, the company has improved their managed SD-WAN services capabilities.

Their global IP backbone and strategic partnerships enable service delivery across more than 150 countries, with particularly strong coverage throughout North America and Europe. To complement this, Verizon's infrastructure includes over 160,000 route miles of fibre, connecting to major business centres and data exchange points globally.

Verizon offers both fully managed and co-managed service options, providing customers access to the Verizon Enterprise Center portal for network visibility and control. Their multi-vendor approach supports various technologies including Cisco and Versa Networks, allowing organisations to leverage existing investments whilst maintaining unified management.

A key differentiator is their integrated LTE/5G wireless backup capability leveraging Verizon Wireless infrastructure. Service guarantees include 24/7 monitoring from multiple global NOCs and defined SLAs featuring sub - 4-hour repair times for critical issues and specific latency guarantees on certain network routes.

Verizon combines managed SD-WAN with either Zscaler cloud security or their own Advanced Threat Protection services, creating a secure network offering that meets regulatory compliance requirements. This approach particularly suits enterprise customers and regulated industries requiring high reliability, though customers report that Verizon's size can occasionally translate to less agility or higher costs compared to smaller providers.

Pros and Cons

Pros

| Integrated 4G LTE backup capability leveraging Verizon Wireless infrastructure |

| One of only three providers with MEF 3.0 SD-WAN certification |

| Maintains position among top three global managed SD-WAN providers |

| Strong financial stability and brand recognition |

Cons

| Geographic coverage varies by region outside core North American markets |

| Higher costs for some international connectivity options |

| Enterprise portal functionality varies compared to specialised providers |

| Less flexibility for custom configurations than smaller providers |

Lumen Technologies

Overview

Lumen Managed SD-WAN solutions for Global companies

Prominent: Typically placed just outside the top three globally

Lumen Technologies (formerly CenturyLink) operates one of the world's largest fibre networks, spanning multiple continents. Their background in telecommunications, combined with strategic acquisitions (including Level 3 Communications), has them well-positioned to offer managed SD-WAN services. With a Tier 1 backbone and particularly strong coverage throughout North America and Europe, Lumen's network infrastructure encompasses over 450,000 route miles of fibre, connecting more than 180,000 on-net buildings and 2,200 public/private data centres globally.

Lumen's Network-as-a-Service approach provides flexible deployment options ranging from fully managed to co-managed SD-WAN, supporting multiple vendor platforms including Versa, Cisco and VMware.

When considering Lumen's underlay options, they deliver 99.99% core network uptime with defined latency commitments across their owned backbone, complemented by 4-hour hardware replacement guarantees in metropolitan areas. Their approach to service delivery emphasises proactive monitoring through AI-powered analytics that preemptively identify and address potential issues before they impact business operations.

Lumen's security capabilities are available through integrations with adaptive threat detection partners and native platform features. Meanwhile, Lumen offers cloud connectivity options for major providers including AWS and Azure, facilitating easy integration with multi-cloud architectures through dedicated private connections.

Whilst Lumen has historically been recognised for its technical excellence and continues to serve demanding enterprise clients, recent market assessments indicate their innovation momentum may be slowing compared to more aggressively expanding competitors. Nevertheless, Lumen remains a reliable choice for organisations requiring predictable performance.

Pros and Cons

Pros

| Approximately 400,000 route miles of fibre globally |

| Serving customers in more than 60 countries |

| Maintains position on US Carrier Managed SD-WAN Leaderboard |

| 12 million fibre miles planned completion connecting 50+ major US cities |

Cons

| Innovation pace varies compared to cloud-native specialists |

| Geographic presence concentrated in certain regions |

| Customer support quality can vary across markets |

| SASE capabilities primarily through partnerships |

Comcast Business (Masergy)

Overview

Comcast Managed SD-WAN solutions for Global companies

Challenger: Number 1 in the US and beginning to expand globally

Comcast Business significantly expanded its global capabilities through the acquisition of Masergy in 2021, combining Comcast's US network infrastructure with Masergy's global expertise. This was essential for Comcast as it allowed them to move from a primarily US-focused provider into a global competitor, particularly for enterprises requiring more complex network management capabilities.

The combined entity now spans over 80 countries across the Americas, Europe and Asia, moving away from Comcast's previously US-centric operations. However, positive remnants of this still show, with their network architecture leveraging Comcast's extensive last-mile infrastructure in North America.

Comcast's service is primarily delivered as a fully managed offering, though customers can access co-management-esque capabilities through their self-service portal. This hybrid approach offers enterprises flexibility where needed but leans primarily on expert oversight and support, which is far better suited for more complex requirements.

One key benefit of Comcast's service is their SLA offerings, including 100% packet delivery across their core network and 99.99% uptime commitments. Their 24/7 NOC support infrastructure provides multi-layered monitoring and management capabilities, with especially strong incident response times for US locations where they maintain direct infrastructure control.

Comcast's integrated security architecture leverages Fortinet for SD-WAN and security components, providing built-in next-gen firewall capabilities, IDS/IPS and optional managed SOC services. On top of this, they offer unified communications (UCaaS) integration, allowing customers to consolidate all of their network and communications services into a single package.

They also stand out for their analytics and AIOps functionality, which continuously optimises network paths and generates anomaly alerts through machine learning algorithms. This technical sophistication is complemented by an award-winning customer service reputation with proactive performance monitoring and alerting, making them particularly attractive to mid-sized enterprises requiring more complex capabilities.

Pros and Cons

Pros

| New leader in US managed SD-WAN market, overtaking AT&T in 2025 |

| Steadily ascended market rankings since 2018 |

| Strong US infrastructure with last-mile control |

| AI-driven network optimisation capabilities |

Cons

| Global expansion developing following Masergy acquisition |

| Higher dependency on partner networks outside North America |

| Newer to large enterprise deployments compared to traditional carriers |

| Security capabilities rely on third-party integrations |

BT

Overview

BT Managed SD-WAN solutions for Global companies

BT are the UK's largest telecommunications provider, serving multinational enterprises across diverse sectors, with their longstanding experience in telecommunications having directly translated into their SD-WAN offerings.

Their global network spans more than 180 countries through their proprietary infrastructure and local partnerships, with particularly strong coverage in EMEA and Asia-Pacific regions. BT's network assets include significant submarine cable investments, multiple global data centres and over 5,400 points of presence worldwide - therefore BT makes an ideal service provider for enterprises with globally dispersed operations.

BT offers fully managed SD-WAN services, supporting a range of vendors solutions. Their vendor agnostic approach emphasises customisation based on individual business requirements, with professional services teams providing consultative guidance throughout implementation and ongoing operations.

Their service commitments are underpinned by high-standard SLAs (99.95% global WAN uptime), MPLS-based underlay networks with regional latency guarantees and 24/7 'follow-the-sun' NOC support delivered through ITIL-based service management processes.

Whilst the built-in security depends on the chosen vendor, BT's security capabilities include firewall management and SASE solutions via partnerships with Zscaler and Palo Alto Networks Prisma.

We'd argue that BT's extensive experience with multinational enterprise deployments and telecommunications is a key differentiator, whilst we'd also recommend BT for their understanding of global regulatory environments and specialised expertise serving highly-regulated industries with strict compliance requirements.

Pros and Cons

Pros

| Global IP backbone with PoPs in 198 countries worldwide |

| Ranked among top global managed SD-WAN providers |

| Strong EMEA coverage and regulatory expertise |

| Available in over 200 countries |

Cons

| Premium pricing structure, particularly for smaller deployments |

| Complex service delivery model can slow implementations |

| Innovation in cloud-native technologies varies |

| Service delivery complexity in some regions |

Vodafone Business

Overview

Vodafone Managed SD-WAN solutions for Global companies

Well known for their extensive mobile network footprint, Vodafone make full use of this to deliver integrated fixed-mobile connectivity solutions. As a major global telecommunications provider with particular strength in mobile services across EMEA and parts of APAC, Vodafone brings a slightly more unique approach to the SD-WAN marketplace.

Beyond their mobile network, Vodafone maintains their own backbone infrastructure and undersea cables in core regions, complemented by partner agreements to extend coverage to approximately 150 countries worldwide. Their network architecture places emphasis on integrating fixed and mobile technologies, providing enterprises with unified connectivity experiences across more diverse access methods.

Vodafone offer fully managed SD-WAN service utilising Cisco Catalyst SD-WAN. This service is backed by service level agreements targeting 99.95% uptime and 4 hour response times for more urgent issues. Their operations infrastructure maintains 24/7 Network Operations Centres in the UK and India, whilst also leveraging local country operations for on-site support in regions where Vodafone operates as an ISP.

Security capabilities include SASE capabilities through partnerships with vendors such as Zscaler and Palo Alto Networks' Prisma Access, providing integrated security features.

Vodafone's key differentiator is fixed-mobile convergence, offering integrated 4G/5G connectivity within its SD-WAN solutions that can serve as backup or primary connections depending on location requirements and, therefore, should be a standout feature for enterprises in very rural locations.

Pros and Cons

Pros

| Fixed-mobile convergence with integrated 4G/5G backup capabilities |

| Mobile and fixed services to over 340 million customers in 15 countries |

| SD-WAN services available in over 184 countries worldwide |

| Ranked among top global managed SD-WAN providers |

Cons

| Limited fixed-line infrastructure outside core markets |

| Dependency on partner networks for many terrestrial connections |

| SASE capabilities primarily through partnerships |

| Service quality can vary by region |

Colt Technology Services

Overview

Colt Managed SD-WAN solutions for Global companies

Visionary: 2024 Frost & Sullivan Technology Innovation Leader in European managed SD-WAN

Colt Technology Services are a UK based telecommunications provider, specialising in high-bandwidth connectivity solutions across Europe, Asia and North America. Colt also place particular emphasis on metro fibre networks in key business hubs and has established itself as a preferred provider for organisations requiring guaranteed performance across financial centres and technology sectors.

Colt's coverage spans 30 countries where they maintain their own infrastructure, with an architecture that can make the most of their own fibre, connecting major business districts, data centres and cloud providers, delivering predictable performance for latency-sensitive applications. This underlay is all harnessed through their fully managed SD-WAN offering, which leverages VMware VeloCloud. It should also be noted that Colt does sometimes offer co-management options for enterprise clients.

Colt's SLA structure includes latency guarantees with financial penalties for non-compliance. When considering performance, a distinctive capability of Colt's offering is their PrizmNet On Demand portal, which allows customers to adjust bandwidth requirements in real-time, providing flexibility for businesses with variable connectivity needs.

For security capabilities, Colt partners with third-party providers such as Palo Alto Networks rather than offering in-house security stacks. This approach focuses on integration quality rather than proprietary solutions, which can be a key factor in accommodating customers with existing security investments or specific compliance requirements.

Colt differentiates through performance metrics, offering industry-leading low-latency routes and quick provisioning, ideal for businesses such as financial trading firms and media companies transferring large datasets. While their global reach is less extensive than larger telecommunications providers, their focused approach delivers superior performance in key business locations.

Pros and Cons

Pros

| 1,100+ data centres across 40+ countries |

| Multiple regional gateways deployed in EU, Asia and US |

| Only SD-WAN provider with fibre across Europe, Asia and the US |

| Real-time bandwidth adjustment capabilities |

Cons

| Limited geographic reach |

| Higher cost per location outside core markets |

| Smaller support organisation compared to tier-1 carriers |

| Less suitable for distributed operations |

GTT Communications

Overview

GTT Managed SD-WAN solutions for Global companies

Challenger: Experienced global managed SD-WAN provider

GTT Communications is a managed service aggregator, combining multiple carriers into a single offering. Following financial restructuring that completed in 2022, GTT has refocused on enterprise services, emphasising their carrier-agnostic approach that mixes various connectivity options (MPLS, internet and 4G) to optimise cost and performance.

Maintaining a tier 1 global backbone, GTT offers network reach across 190 countries, leveraging partnerships to remove the necessity of owning last-mile infrastructure everywhere. Notably, GTT have no upstream providers and maintain direct peering relationships globally, reducing latency and improving performance.

GTT offers both fully managed and co-managed service models, supporting technologies from vendors such as HPE Aruba and Fortinet.

GTT offers standard 99.9% end-to-end uptime commitments with service credits for outages exceeding 4 hours. They maintain 24x7 Network Operations Centres in both the US and EMEA regions, providing proactive monitoring of their backbone and customer sites.

For security integration, GTT partners with established vendors such as Fortinet and Palo Alto Networks rather than developing proprietary solutions. Their portfolio includes SASE and direct cloud connectivity services to major providers including AWS and Azure, facilitating hybrid cloud architectures with consistent performance.

GTT's key differentiation comes from their "build anywhere" capability that avoids carrier lock-in, making them particularly suitable for organisations that don't want to rely on a single vendor or in rural locations where vendors aren't present across all regions.

Pros and Cons

Pros

| Tier 1 IP backbone with over 450 PoPs across six continents |

| Connecting over 140,000 customer locations across over 170 countries |

| Direct peering relationships as Tier 1 provider |

| Carrier-agnostic approach prevents vendor lock-in |

Cons

| Reported bankruptcy restructuring in 2021 |

| Service quality can vary across partner networks |

| Limited direct infrastructure ownership compared to major carriers |

| Smaller scale compared to telecommunications giants |

Aryaka

Overview

Aryaka Managed SD-WAN solutions for Global companies

Innovative: Consistently recognised in Gartner’s Magic Quadrant for WAN Edge Infrastructure

Aryaka operates as a cloud-first SD-WAN and SASE provider with its own global private network, offering an alternative to traditional carrier approaches. Aryaka pioneered the delivery of network-as-a-service solutions specifically designed for global enterprises requiring predictable performance.

Their architecture includes 40 globally distributed Points of Presence, connected by a private core network, enabling service delivery in over 100 countries. Unlike carriers, Aryaka emphasises middle-mile infrastructure optimisation, addressing a common performance bottleneck for global applications, which can significantly benefit the SD-WAN overlay.

Aryaka exclusively provides a fully managed service model, handling all aspects of deployment, management and ongoing optimisation.

Aryaka's network guarantees SLAs of 99.99% uptime and region-specific latency promises, which is all supported by extensive performance monitoring and optimisation. To further support their customers Aryaka also provides 24/7 global support infrastructure with multi-layer monitoring of both network performance and application-level metrics.

Their integrated network security portfolio features a unified SASE solution that combines SD-WAN technology with firewalling and web security hosted at their PoPs, alongside a managed remote access solution for secure WAN access.

Aryaka stands out for their Network as a Service and SD-WANaaS offering, particularly beneficial in challenging regions and Asia-Pacific.

Pros and Cons

Pros

| Over 40 global PoPs connected by fully meshed Layer 2 private network |

| 95% of global business users within 30ms of PoPs |

| Service spans six continents with SLAs |

| Integrated SASE capabilities without third-party dependencies |

Cons

| Higher cost than traditional carrier-based solutions |

| Limited customisation due to standardised platform approach |

| Smaller ecosystem compared to major telecommunications providers |

| Focus on mid-market rather than largest enterprise segments |

Provider Recommendations by Business

Large Multinational Enterprises (5,000 employees and up)

- Primary Recommendation: AT&T Business or BT for global coverage and regulatory expertise

- Alternative: Verizon Business for North American focus

- Key Factors: Prioritise SLA guarantees, multi-vendor support and more assured compliance frameworks

Mid-Market Companies (500–5,000 employees)

- Primary Recommendation: Comcast Business for North American operations, BT or Vodafone Business for EMEA focus

- Alternative: Aryaka for Asia-Pacific presence or challenging geographic requirements

- Key Factors: Balance cost efficiency with service quality, emphasise co-managed options for retained control

Distributed Retail/Branch Operations

- Primary Recommendation: Hughes Network Systems for remote locations, MetTel for automated management

- Alternative: Zayo Group for metro-focused operations with fibre requirements

- Key Factors: Satellite backup capabilities, rapid deployment, standardised configurations

Financial Services/Trading Firms

- Primary Recommendation: Colt Technology for ultra-low latency, Zayo Group for fibre-based performance

- Alternative: Lumen Technologies for bandwidth-intensive applications

- Key Factors: Latency guarantees with penalties, dedicated fibre infrastructure, regulatory compliance

Emerging Markets/Complex Geographic Requirements

- Primary Recommendation: Aryaka for Asia-Pacific strength, GTT Communications for carrier-agnostic approach

- Alternative: IBM for complex integration requirements

- Key Factors: Local presence, partner portfolio, flexible deployment options

Harry holds a BSc (Hons) in Computer Science from the University of East Anglia and serves as a Cybersecurity Writer here at Netify, where he specialises in enterprise networking technologies. With expertise in Software-Defined Wide Area Networks (SD-WAN) and Secure Access Service Edge (SASE) architectures, Harry provides in-depth analysis of leading vendors and network solutions.

Fact-checked by: Robert Sturt - Managing Director, Netify